Enjoying the convenience of money transfers through United Payment Interface (UPI)? According to reports, UPI-based transactions grew more than 20 times since India government demonetization or digital India push. With banks, third party apps like PhonePe and mobile wallets like Paytm are further promoting the cashless payments. Till now all UPI-based money transfer were not been charged by banks. But this gone change pretty soon and your UPI transactions to get costly.

To start with, one of India’s biggest private bank, HDFC Bank will soon start charging its customers for money transfer through UPI. In a recent email to its customers, the bank confirmed the charges for all UPI outward transactions from 10th July 2017. Note that only the person-to-person (P2P) based UPI transactions are charged. That’s when you send money using UPI to your friends or family. Person-to-merchant (P2M) based UPI transactions will still remain free, thanks to NPCI guidelines. That’s your money transfer to merchants in stores or buying an item online via UPI will still remain free.

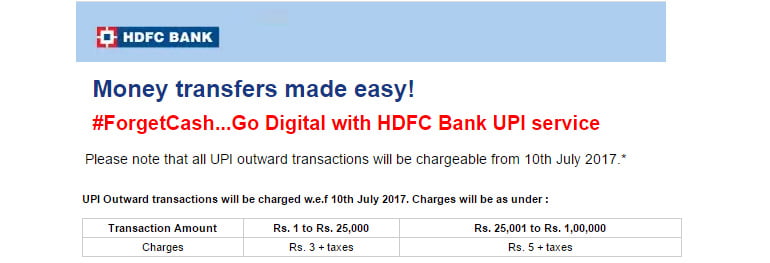

Starting 10th July, HDFC Bank will be charging flat Rs 3 plus taxes for all P2P UPI money transfer of Rs 1 to Rs 25,000. For P2P UPI money transfer of Rs 25,001 to Rs 1,00,000, the bank will be charging Rs 5 plus taxes. The maximum you can send via UPI is limited to one lakh per transaction.

As one major bank has started charging for UPI transactions, other private and public sector banks will follow the route. According to LiveMint, India’s largest public sector bank State Bank of India (SBI), has also hinted at levying charging on UPI transfers in the coming months.

Charges on UPI money transfer

- Charges on person-to-person (P2P) money transfer via UPI.

- HDFC Bank to charge Rs 3 (plus taxes) for UPI money transfer up to Rs 25,000. Also, Rs 5 (plus taxes) for UPI money transfer of Rs 25,001 to Rs 1,00,000.

- Charge for UPI transactions starting 10 July 2017.

- Other private and public sector banks to start charging for UPI transaction in the coming months.

- UPI money transfer to merchants (Person-to-merchant (P2M)) will still remain free.

Unified Payment Interface (UPI) is the latest payment system by National Payments Corporation of India (NPCI) for the India government vision towards the cashless digital economy. It’s a more advanced version of IMPS, which lets you transfer money in real-time, 24×7 and via mobile. India government launched Bharat Interface for Money (BHIM) mobile app that lets you make easy and quick money transactions using UPI. The mobile app is available for both Android and iOS devices.