Updated at December 30, 2016:

NPCI’s Official UPI app – BHIM (Bharat Interface for Money) is finally here. BHIM supports all the live UPI members (Banks).

Things to ponder before registering BHIM

- Use the mobile number linked to your bank account for registering BHIM.

- BHIM needs a 6 digit UPI- PIN so you might have to generate a new one.

Our original story from Saturday, December 31, 2016, follows:

Unified Payment Interface (UPI) is the latest payment system by National Payments Corporation of India (NPCI) for the Reserve Bank of India’s (RBI) vision towards the cashless digital economy. The UPI allows P2P (peer-to-peer) and merchant money transfers directly from your bank account via a mobile application. It’s a more advanced version of Immediate Payment Service (IMPS), which lets you transfer money in real-time, 24×7 and without exposing your personal details. You can transact a minimum of Rs 50 to all way up to Rs 1 lakh in a single transaction.

Key aspects of UPI

- Send and receive money instantly using your smartphone.

- Payments can be initiated either by the sender (payer) or receiver (payee).

- 24X7 and real-time funds transfer service, even on public/bank holidays.

- Transaction limit – minimum Rs 50 and maximum Rs 1 lakh per transaction.

- Transactions are performed in a secure manner abiding RBI guidelines.

- UPI transactions are secured with two-factor authentication and can use biometric authentication via user’s smartphone (fingerprint scanner or retinal scanner).

Performing a UPI transaction is a piece of cake, all you need is to use your Virtual Payment Address (VPA) created in association with your bank account. Using that you can send and receive money without sharing any additional bank information like the too long account number or IFSC code. Your VPA will look something like “your name/number@psp” (PSP or Payment Service Provider, ie your bank). This becomes your personal identification number for all banks accounts.

However, to start using UPI, your mobile number must be registered with your bank account either during KYC verification or while using mobile banking, OTP or other related services. If not, contact your bank’s branch or use mobile banking app or even ATMs for adding your mobile number.

Creating your VPA

For any transaction to be carried out in UPI, you need to create a Virtual Payment Address for your bank account. It’s a unique ID like your bank account number or mobile number. You can create multiple VPA-associated with multiple bank accounts. There is also an option to change your VPA-associated with a bank account.

- Download the respective Bank’s UPI application in your mobile phone from the list below.

- Register yourself along with mobile device on the Bank’s app and set a secure password (your mobile number must be associated with your bank account).

- Create your Virtual Payment Address (for example – username@psp or username@sbi). You can use any alphabet or number combination for creating the VPA, its just need to be unique.

- You will also need to create MPIN password, which is required for all future transactions (maestro cards are not supported).

How to send money or pay using UPI

- Open you Bank’s UPI app and select transact money.

- Enter the other users Virtual Payment Address ( the app will verify whether a payee exists under that VPA and retrieves the payee name automatically).

- Enter the amount you wish to transact along with any remarks. Then initiate the transaction.

- Use your MPIN to authenticate the transaction.

- The amount from your bank account will be instantly transferred to the other person’s bank account.

How to collect or request money using UPI

- Open the bank UPI app and select collect money.

- Enter other persons Virtual Payment Address (app will verify whether the person exist under that VPA and retrieves the name automatically)

- Enter the amount you are requesting along with the request expiry time (minutes or days) and then submit the request.

- You’ll receive a notification saying the collect request was created successfully.

- You will get another message or notification when the user has paid money to your request.

How to approve collect request using UPI

- If your friend’s or a merchant is requesting money via UPI method, you’ll receive a notification/SMS from your bank stating the amount requested along with VPA of the requester.

- Log in to your Bank’s UPI app and select approve requests.

- Authorize the transaction using your MPIN.

- The requested money will get instantly transferred to the requester’s bank account.

How to check UPI-based transactions

- You can see all the UPI-based transaction reference in the Bank’s UPI app.

- In your bank statement, these transactions will appear as IMPS transactions.

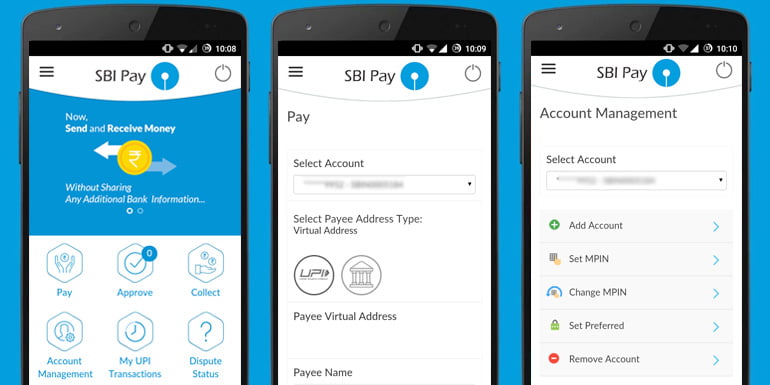

Please note that each banking app has it’s own UPI transaction menu layouts. We have used SBI Pay and ICICI iMobile as a reference for this article. You can also map your VPA to any bank account, if the particular bank’s UPI app allows you. For example vpa@icici can be mapped to a SBI account using ICICI banking apps.

List of Banks supporting UPI

| Sr. No | Bank Name | Details | Mobile Apps |

| 1 | Allahabad Bank | PSP & Issuer | Allahabad BankUPI |

| 2 | Andhra Bank | PSP & Issuer | Andhra Bank ONE |

| 3 | Axis Bank | PSP & Issuer | Axis Pay |

| 4 | Bank of Baroda | PSP & Issuer | Baroda MPay |

| 5 | Bank of Maharashtra | PSP & Issuer | MAHAUPI |

| 6 | Canara Bank | PSP & Issuer | Canara BankUPI – Empower |

| 7 | Catholic Syrian Bank | PSP & Issuer | CSBUPI |

| 8 | Central Bank of India | PSP & Issuer | CentUPI |

| 9 | DCB Bank | PSP & Issuer | DCB Bank |

| 10 | Federal Bank | PSP & Issuer | Lotza |

| 11 | HDFC Bank | PSP & Issuer | HDFC Bank MobileBanking |

| 12 | ICICI Bank | PSP & Issuer | Pockets- ICICI Bank |

| 13 | IDFC Bank | PSP & Issuer | IDFC BankUPI App |

| 14 | Indian Bank | PSP & Issuer | IndianBankUPI |

| 15 | IndusInd Bank | PSP & Issuer | IndusPayUPI App |

| 16 | Karnataka Bank | PSP & Issuer | KBL Smartz |

| 17 | Kotak Mahindra Bank | PSP & Issuer | Kaypay |

| 18 | Oriental Bank of Commerce | PSP & Issuer | OBCUPI PSP |

| 19 | Punjab National Bank | PSP & Issuer | PNBUPI |

| 20 | RBL Bank | PSP & Issuer | RBLPay |

| 21 | South Indian Bank | PSP & Issuer | SIB M-Pay (UPIPay) |

| 22 | State Bank of India | PSP & Issuer | SBI Pay |

| 23 | TJSB Bank | PSP & Issuer | TranZapp |

| 24 | UCO Bank | PSP & Issuer | UCOUPI |

| 25 | Union Bank of India | PSP & Issuer | Union BankUPI |

| 26 | United Bank of India | PSP & Issuer | UnitedUPI |

| 27 | Vijaya Bank | PSP & Issuer | VijayaUPIApp |

| 28 | Yes Bank | PSP & Issuer | Yes Pay |

| 29 | Dena Bank | Issuer | |

| 30 | HSBC | Issuer | |

| 31 | IDBI Bank | Issuer | |

| 32 | Standard Chartered Bank | Issuer | |

| 33 | Syndicate Bank | Issuer |

Where can use UPI

So where can use UPI? Instead of paying hard cash during a COD order or while buying from groceries stores, you can use instantly transfer the money using UPI. You just need to know the other persons VPA to transfer the required money to his/her bank account. UPI also work while paying utility bills, doing recharges, barcode (scan and pay) based payments, donations, school fees, fund transfer your friends or family and more. So, now on you just don’t need to carry around cash or credit/debit cards. Use your smartphone and UPI supported bank app to go cashless.

If you have more than one bank account then managing multiple VPA accounts with multiple bank UPI apps is a tedious task. Well, we got a solution for that too. India’s largest online shopping retailer Flipkart has launched India’s first UPI-based mobile payments app – PhonePe. It’s actually a mobile digital wallet app that allows you to receive or transfer money to your family and friends directly from your bank account using UPI.