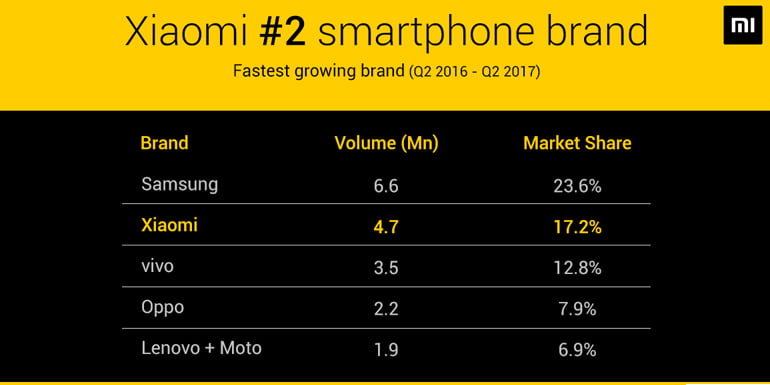

Xiaomi’s share in Indian smartphone market has been increasing ever since they made into the top five back in Q3 2016. Meanwhile, Samsung managed to keep the lead, other top players have seen ups and downs. IDC(International Data Corporation) analysis shows that Chinese based vendors are now the majority market players. Let’s take a quick look at the latest report and see how Xiaomi managed to climb up and stayed safe.

Game Plan

Xiaomi expanded to the Indian market in the year 2015 by launching Mi4i through two of major e-commerce sites. Following which they released about 12 devices in India till date. These include Redmi 2, Redmi 2 Prime, Redmi Note 3, Redmi Note Prime, Mi5, Redmi 3S, Redmi 3S Prime, Redmi 3S Plus, Mi Max, Redmi Note 4, Redmi 4A, and Redmi 4. These aptly priced smartphones did charm the Indian smartphone customers as they managed to get into their hearts. In the meantime, Xiaomi started to shift its focus to offline market by launching offline exclusive phone Redmi 3S Plus. For this, they partnered with offline distributors like Sangeetha, LOT Mobiles, Poorvika and more.

Owing to the increased reception of their products, they also partnered with HCL to give better service to customers. Later when they launched the Redmi Note 4, the flash sales couldn’t satisfy the demanding fans. So they came up with the idea of online and offline pre-booking. Moreover, they started manufacturing and assembling phones in India by becoming a part of the Make in India initiative. On 20th May 2017, they launched the first ever Mi Home in India, where fans can experience products first-hand. By the second quarter of 2017, Xiaomi was able to triple the offline shipments. With over 2 million shipments, RN4 is now the highest shipped smartphone in a single quarter in the Indian smartphone history

Rivals

During these years fellow Chinese vendors like OPPO, OnePlus, and Vivo also tried the offline strategy, but couldn’t race with Xiaomi. Market share of Xiaomi grew from 7.4 percent in Q3 2016 to 17 percent in Q2 2017, climbing up from fourth to the second position in a short span of time. On the other hand, Indian vendors like Micromax and Reliance Jio LYF toppled in sales. The market leader Samsung also made a great fightback to stay on top even after the Note 7 explosion episode.

Forecast

All these vendors have upcoming planned releases like Xiaomi’s Redmi Note 5A, Redmi Note 5, Samsung’s Note 8 and more. On a different note, Reliance Jio is trying to conquer the feature phone market with their effective zero priced JioPhone. The smartphone market managed a modest growth compared to the previous year with 28 million units, while that of feature phone remained almost flat at 34 million. However, the JioPhone might be a game changer in the feature phone arena. To sum up, the smartphone market is again ready for a festive sale after the bumpy ride. The big game is yet to be played, hope you enjoyed the article, Peace!