It seems the continuing free data and voice offer from the new entrant in Indian telecom space, Reliance Jio has to a large extent disturbed other telecom operators growth. According to the latest Telecom Regulatory Authority of India (TRAI) telecom subscription data, Reliance Jio is the top wireless broadband service provider, pushing Airtel down to the second spot. Reliance Jio has 52.33 million subscribers actively using its data service. Whereas Airtel has only 41.90 million subscribers using its data services.

During the month of November 2016, Reliance Jio added 16.26 million new subscribers to its network. In the previous month also Jio added around 19.6 million new subscribers to its network. If we consider the subscriber addition of other Indian telecom networks, Idea Cellular is in the distinct section position with 2.52 million new subscribers. Followed by Airtel adding 1.05 million new subscribers and Vodafone India adding 0.89 million subscribers. This clearly shows the user attraction towards Reliance Jio, who managed to add almost eight times more new subscribers to its network than any rival telcos.

Highlights of Telecom Subscription Data (30th November 2016 )

- The number of telephone subscribers in India touched 1,123.96 million with a monthly growth rate of 1.91 percent.

- The overall teledensity in India increased to 87.81 at the end of November 2016.

- Total wireless subscriber base which also includes the mobile subscribers in the country increased to 1,099.51 million.

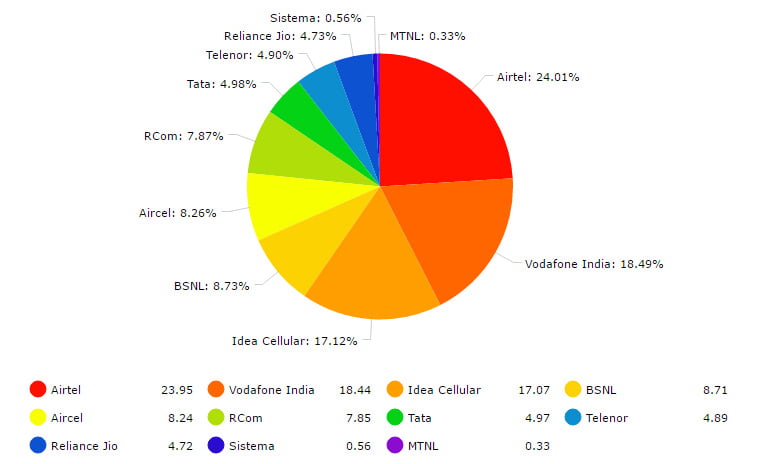

- Private telecom operators hold 90.96 percent of Indian telecom market share. Whereas the two PSU telecom operators BSNL and MTNL have a market share of 9.04 percent.

- Reliance Jio grabs the maximum number of subscribers to its network, followed by Idea Cellular and Airtel.

- On the losing side, Tata Teleservices lost around 1.09 million subscribers during this period.

- Airtel still holds the top position in India telecom sector with 23.95 percent market share. Followed by Vodafone India with 18.44 percent market share and Idea Cellular with 17.07 percent market share. It to be noted that the top three telcos are continuously losing its market share to new entrants.

- Reliance Jio showed a massive growth rate of 45.67 percent when compared, Idea has a growth rate of just 1.6 percent.

- Out of the total wireless subscriber base, 968.83 million wireless subscribers were active on the date of peak VLR in the month of November 2016.

- Wireline subscriber base which includes BSNL landline declined to 24.44 million.

- In the month of November 2016 alone a total of 4.76 million requests were received for Mobile number portability (MNP).

Highlights of Broadband Data (30th November 2016 )

- The number of broadband subscribers, which include both mobile and wired subscribers decreased to 218.26 million at the end of November 2016. Thus registering a monthly negative growth rate of -0.07 percent.

- Taking mobile broadband subscribers alone, Reliance Jio takes on Airtel to grab the top spot with 52.23 million subscribers. Airtel stands second with 41.90 million subscribers and Vodafone India at third with 34.87 million subscribers.

- On wired broadband connection, BSNL tops with 9.95 million subscribers, followed by Airtel with 2.03 million subscribers.