For the first time, Reliance Jio has beaten one of the three top telecom operators in the country, in a telecom circle. In Kerala telecom circle, Reliance Jio has overtaken Airtel to become the fourth largest telco in the state.

According to the latest Telecom Subscription Data as on 30th November 2017 published by TRAI, in Kerala telecom circle Airtel has 48,19,002 subscribers, whereas Reliance Jio has topped them with 49,26,286 subscribers. Still Idea Cellular rules Kerala circle with 11.48 million subscribers.

In terms of subscriber addition too, Reliance Jio topped the chart by adding more than 6.11 million new subscribers to its network in November 2017 alone. Airtel was able to add 4.34 million subscribers and Idea Cellular added 3.19 million new subscribers during the same period.

Reliance Communications (RCom) however lost most of its subscribers during the period. This is understandable as the telco announced the shutdown of its wireless services due to heavy debt. It’s last acquisition Sistema (MTS India) also lost most of its subscribers fearing the service shutdown.

Stats on Telecom Subscription (November 2017)

- The number of telephone subscribers in India declined further and now stands at 1,185.88 million.

- The total wireless subscriber which also includes GSM, CDMA and LTE subscribers in the country also declined to 1,162.47 million.

- Private telecom operators hold 90.44 percent market share in Indian telecom sector. Whereas the two PSU telecom operators BSNL and MTNL have been improving their market share and now holds 9.56 percent market share.

- Reliance Jio added the maximum number of subscribers to its network, followed by Airtel, Idea Cellular, Vodafone India and BSNL.

- On the losing side, RCom topped the chart followed by Sistema (MTS, also owned by RCom) and Tata Teleservices.

- Out of the total wireless subscribers, only 1,006.40 million wireless subscribers were active on the date of peak VLR in the month of November 17. The proportion of active wireless subscribers was approximately 86.57 percent of the total wireless subscriber base.

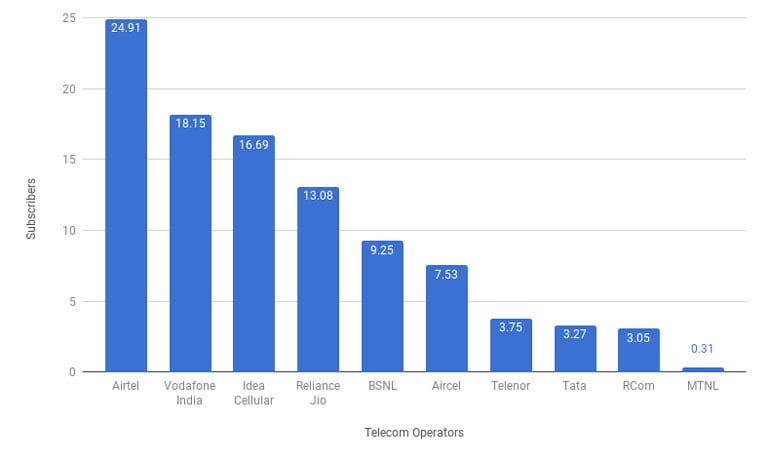

- Airtel retained the top position in India telecom sector with 24.91 percent market share. Followed by Vodafone India with 18.15 percent market share and Idea Cellular with 16.69 percent market share.

- Reliance Jio with 13.08 percent market share is quickly closing the gap between the incumbent telcos.

- Wireline subscriber base declined further to 23.41 million in November 2017. BSNL top’s the wireline segment with 53.64 percent market share, followed by Airtel with 16.69 percent market share.

- Thanks to the closing down announcement from RCom and merger news from Tata Teleservices, Mobile number portability (MNP) request shot up to a total of 15.99 million in November 2017 alone.

Stats on Indian Broadband (November 2017)

- The number of broadband subscribers, which include both mobile and wired subscribers increased to 350.70 million at the end of November 2017.

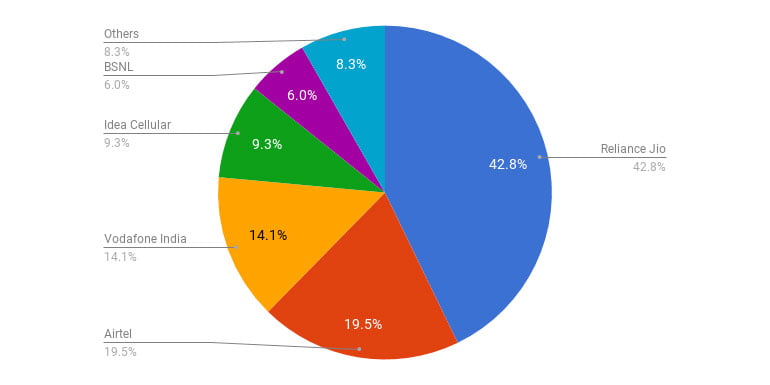

- Reliance Jio tops the chart in data market in the country with 152.08 million subscribers. Airtel takes the second spot with 69.38 million data subscribers.

- Counting wired broadband connection, BSNL tops with 9.43 million subscribers. On the second spot, we have Airtel Broadband with 2.14 million subscribers.

- Again, in the Wireless broadband service providers list Reliance Jio tops the chart, followed by Airtel and Vodafone India.