Updated at November 26, 2016:

Paytm has completely withdrawn the facility citing security concerns from card processors Visa, and MasterCard along with industry bodies.

http://www.datareign.com/paytm-withdraws-mobile-app-pos-facility-merchants.html

Our original story from Thursday, December 15, 2016, follows:

Are you a store owner, have your sales gone down due to the sudden demonetization the Rs 500 and Rs 1000 currency notes by the government? Well, you can go cashless by accepting digital payments from customers.

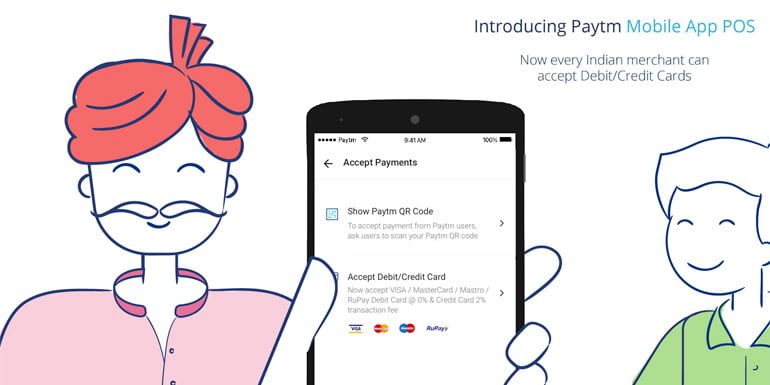

One of India’s leading digital wallet provider Paytm has introduced ‘Paytm Mobile App POS’ (Point of sale). Nope, you don’t need to buy pricey POS machines, apply and wait for bank verification and so on. By using Paytm app, merchants can instantly start accepting debit card and credit card payments from their customer.

Currently, the Paytm Mobile App POS works with RuPay, Visa, and MasterCard debit cards and credit cards issued by Indian banks. Shopkeeper and merchants can instantly start accepting debit card and credit card payments from any customer using Paytm App. In a month merchants can do transaction worth Rs 50,000, which they can freely transfer back to their bank account. To increase the transaction limit shop owners or merchants need to verify their account by submitting KYC documents.

How to use Paytm Mobile App POS

- Started by selecting ‘Accept Payment’ option on Paytm mobile app.

- Enter the bill amount for the purchase made by the customer.

- Then select ’Accept Debit/Credit card’ payment.

- Give the mobile to the customer to enter his/here debit or credit card details.

- Customer will receive an OTP on their mobile number (link to the debit/credit card), which then used to authorise the transaction.

- Once the transaction is complete, money will be instantly credited to the merchants Paytm account.

- Merchant will show you a digital receipt of the transaction on his/her smartphone. Also, the customer will get a payment confirmation/failure notice via SMS.

The best part, Paytm Mobile App POS service will be free for the customers. There are no transaction charges from the merchant’s end as well, till 31st December 2016. The Paytm PCI-certified firm and follows all regulatory guidelines prescribed by the RBI. Paytm app will never save customers debit and credit card numbers or CVV details, as mandated under PCI DSS standards.

Paytm has recently launched ‘Nearby’ feature where you can find stores and merchants accepting Paytm wallet cash near your location. To pay money, you only need the merchant’s mobile number or email id or the Paytm QR code.